As every Monday, we present precious metal prices last week. How have the quotations of metals found in car catalysts – platinum, palladium and rhodium – changed? We will not forget to mention gold and silver as well as currency exchange rates.

The previous described week began not very well for platinum, but it ended with quite a big increase. In the case of the last one, virtually every day meant an ever greater drop in prices. The initial value of an ounce of this precious metal was less than USD 835 on Friday. Already after the weekend it decreased by 12 dollars, and this is just the beginning of a bad run. Subsequent quotations only deepened the bad situation. The largest drop in prices was recorded on Wednesday and Thursday. Then the chart line exceeded 800 USD / oz and reached even lower. The minimum value of last week is 796 USD / ounce. Only Friday resulted in a slight improvement of the situation. The week ended with a quotation of 802 USD / ounce. We count on improvement!

Source: bankier.pl

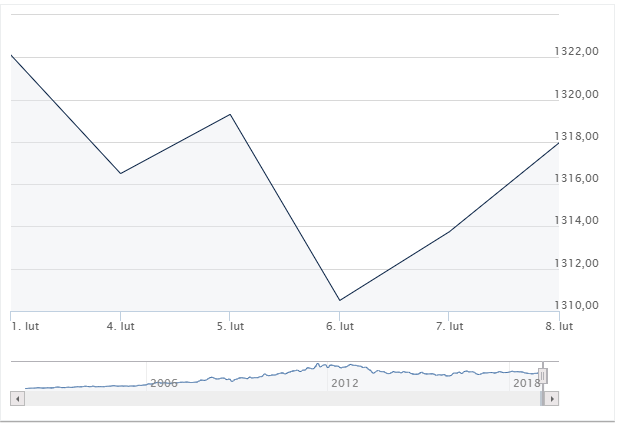

In the case of palladium, the thing is quite different. The last time we wrote about a drastic – more than a 30-dollar drop. This time, practically all week was full of exchange rate increases. „Practically,” because on Wednesday we were dealing with a small decline. The overall impression, however, is very beneficial. The graph has climbed up in a spectacular and systematic way. So how much did the course increase? On Friday, we had quotes worth $ 1,306 / ounce. On Tuesday, it was already almost $ 1,349 / ounce, or as much as nearly $ 43 more in such a short time. It was true that on Wednesday we were dealing with a small drop, but the value dropped only by 4.65 USD / ounce, and further quotations only sealed success. On Friday, February 8, the final palladium value was $ 1,379.90 / ounce. The record for January 17 is still a bit lacking, but if the growth persists and its dynamics will resemble those of the last few days, we will be on the right track to break this record. Be sure to be with us so you do not miss anything.

As always, great popularity is aroused by family quotations. What was the situation last week? Recently, we wrote about the good streak of this metal. And this time we were not disappointed. Maybe there were no big surprises, but the situation turned out to be stable. For most days, the value was stable and safe at USD 2,350 / ounce. At the end of the week, we could even enjoy an increase of up to USD 2,360 / ounce.

How were gold prices formed? It turns out that completely different than the previous time. This time the price of an ounce was hesitant. We said goodbye to the weekend with a value of 11 dollars less. On Tuesday, there was a slight increase. Wednesday is another break in the course – a fall of almost $ 9. Even the increase recorded at the end of the week did not make up for losses from the whole week. The final listing was $ 1,318 / ounce. It is also worth mentioning that the NBP ceased to invest in this precious metal. January turned out to be the next – the third consecutive month when Poland did not increase its gold reserves. These are not yet official information. We will have to wait for this until February 21.

The silver graph looks a bit less chaotically than gold. Here much less hesitation. Monday and Tuesday ended in a drop of 0.22 USD / ounce. Later there was another, this time a considerable drop to the value of USD 15.64 / ounce. After reaching this minimum value, there was a return of the action – Thursday and Friday caused a breakdown of the bad situation. The increase led to $ 15.83 / ounce, which ended the week. Losses from a few days could not be achieved. Maybe it will be this week?

The EUR / PLN exchange rate, apart from the beginning of the week, practically increased throughout the whole last week. On Thursday he reached the maximum listing – 4.3046. This is the highest course for over a month. The same applies to the USD / PLN exchange rate. Growth continued uninterrupted from February 1 to reach PLN 8,8101 on 8.02.

Current prices of precious metals can always be found in our Stock Exchange rates tab.

We invite you for further analysis!